2025 Online Business Exit Trends: Insights for Sellers

As more founders build profitable digital ventures, and as acquisition interest rises from both individuals and institutions, the gap between buyers and sellers is narrowing. Yet, with increased activity comes new challenges: shifts in buyer expectations, evolving valuation benchmarks, and competition from both aggregators and solo acquirers.

This article breaks down the current state of online business exits in 2025: what’s trending, what’s fading, and what both buyers and sellers need to know to navigate this maturing ecosystem.

The insights and data presented in this article are drawn from Flippa, a platform to buy and sell online businesses - as well as proprietary trends reports and valuation benchmarks sourced directly from their marketplace activity across thousands of deals.

Whether you're preparing for a sale or evaluating your next acquisition, this snapshot of the 2025 market will help you act with confidence.

The 2025 Exit Market at a Glance: Listings, Prices & Timing

The online business M&A landscape in 2025 is characterized by a surge in activity, with a 32% increase in completed deals compared to the previous year. However, the average transaction value has decreased by 33% to $335,000, indicating a shift towards smaller, more agile acquisitions.

Notably, there has been a significant uptick in listings under $500K on the Flippa platform, reflecting the growing trend of solo founders and micro-acquisitions. This shift suggests that individual entrepreneurs and small teams are increasingly participating in the buying and selling of online businesses.

What’s Hot (and What’s Not)

As the Flippa platform facilitates around 12,000 deals annually, their data offers unique insights into the types of assets being bought and sold. In the past 12 months, the top five online business types sold were:

Ecommerce – 37.7%

Content (e.g., blogs, directories) – 29.9%

SaaS – 11.5%

Apps – 6.2%

Service-based (e.g., agencies, online courses, consulting) – 5%

While these categories continue to dominate in terms of volume, new patterns are emerging in buyer interest and deal momentum.

One of the standout trends is the rise of YouTube-based businesses. Although not yet in the top five by sales volume, YouTube acquisitions have surged with deal activity on Flippa increased by 170% over the past year. YouTube was also the second-most searched term on the platform, just behind Shopify, highlighting strong buyer appetite for video-first, audience-driven assets with monetization potential.

Agencies and SaaS businesses also saw notable upticks in buyer demand, with deal volume increasing by 46% and 21% respectively. Within SaaS, AI-powered tools are commanding significant premiums. Valuation multiples for these businesses now range between 8x and 25x ARR, depending on growth stage, defensibility, and product-market fit. Buyers are clearly placing a higher value on automation, recurring revenue, and operational leverage.

The market is also increasingly international in scope. In the last year, 85% of all transactions on Flippa took place between buyers and sellers in different countries, an extraordinary indicator of how digital assets transcend borders and how platform-based businesses can be effectively acquired and run from anywhere.

Conversely, some business models are beginning to lose favor. Dropshipping and high-risk crypto sites—once popular among first-time buyers—are now viewed with more caution. Buyers in 2025 are prioritizing sustainable operations, clear financials, and long-term defensibility over short-term arbitrage or speculative plays. As a result, these categories are seeing reduced valuations and slower deal cycles compared to previous years.

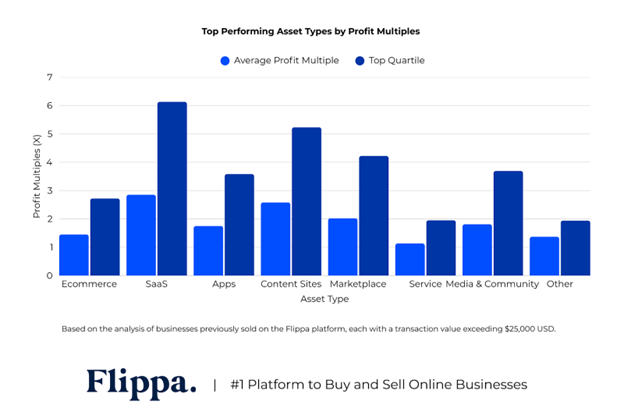

The chart below shows which types of online businesses are selling for the highest profit multiples. SaaS, content sites, and marketplaces are leading the pack, with SaaS businesses selling for up to 6.13x their annual profit in the top quartile. It’s a clear sign that buyers are willing to pay a premium for proven, scalable digital assets.

What Sellers Need to Know about Buyer Behavior & Expectations

Buyers in 2025 are exhibiting greater selectivity, focusing on businesses with:

clean financials

transferable traffic

recurring revenue streams

The due diligence process has become more rigorous, with an emphasis on verifying customer retention rates, acquisition channels, and the scalability of operations. Financial transparency and operational documentation are no longer nice-to-have but rather prerequisites for serious buyer engagement.

There’s also a clear shift toward more structured deal terms. Earn-outs and performance-based agreements are becoming increasingly common, especially for higher-value transactions. These structures allow buyers to de-risk the acquisition while giving sellers the opportunity to unlock additional value post-sale, provided certain targets are met.

Search data on Flippa reveals what’s driving buyer interest right now. The fastest-growing search terms include:

“Profitable SaaS Australia” (+240%)

“AI-powered business” (+195%)

“YouTube channel revenue” (+165%)

“Amazon FBA profitable” (+145%)

Notably, searches that include the word “profitable” are up 200% overall—underscoring that buyers in 2025 are far more focused on proven earnings than on speculative growth stories.

This demand isn’t confined to one geography. American buyers continue to dominate, accounting for 56% of all transactions, followed by EMEA buyers (29%) and APAC buyers (14%). Cross-border activity now represents 85% of all deals on Flippa, reflecting the growing global appetite for digital assets and the increasingly borderless nature of online business ownership. High-value transactions, in particular, lean international: 67% of $1M+ deals involve U.S. buyers, while cross-border deals in the $100K–$1M range often secure sale prices 15–30% higher than domestic-only offers.

The takeaway? Buyers in 2025 are cash-flow focused, globally distributed, and more demanding, but also more willing to pay a premium for quality, documented, and scalable digital businesses.

What Buyers Needs to Know about Seller Sentiment & Motivation

Sellers in 2025 are driven by a mix of personal and market-based motivations. For many, burnout and the desire to reallocate capital toward new ventures remain strong drivers. Others are transitioning careers, using a successful exit as a stepping stone toward their next professional chapter. A growing cohort of serial entrepreneurs is also emerging: individuals who build digital businesses with the clear intention of exiting early, taking advantage of favorable market conditions and a more mature, acquisition-ready ecosystem.

The seller demographic is changing as well. More younger entrepreneurs and solopreneurs are entering the market, driven by the accessibility of no-code tools, global marketplaces, and the increasing legitimacy of online entrepreneurship as a long-term career path. As a result, the profile of the average seller has diversified significantly compared to just a few years ago.

Recent interest rate stabilizations have made financing more accessible for buyers, expanding the buyer pool and increasing competition for high-quality digital assets. Anticipated regulatory shifts in the coming years are expected to reshape the deal-making landscape, prompting many founders to consider exiting sooner rather than later. At the same time, rapid adoption of AI and ongoing digital transformation across sectors has driven strategic demand for scalable, tech-enabled businesses.

Economic uncertainty and recession concerns are also influencing buyer behavior—many are prioritizing cash-flowing digital assets, creating a favorable environment for sellers seeking premium valuations. Globally, billions in capital have been allocated toward the acquisition of digital businesses, highlighting strong investor appetite and offering founders a unique opportunity to capitalize on heightened demand.

For many sellers, 2025 doesn’t just seem like a good time to exit; it seems like the right time.

Exit Multiples & Valuation Data

Not all startups are valued the same — multiples vary depending on the type of business and how it's structured

SaaS Businesses: Multiples range from 4x to 8x ARR, influenced by factors like customer retention and growth potential

AI Startups: High-growth AI startups can command multiples between 10x and 50x revenue, depending on their stage and market traction

E-commerce Stores: Valuations typically fall between 2x and 3x SDE, with strategic buyers occasionally offering higher multiples for brands with strong customer loyalty.

Challenges in the 2025 Market

Several challenges are influencing the online business M&A landscape:

Regulatory Changes: Evolving tax laws and compliance requirements are adding complexity to cross-border transactions.

Market Saturation: Increased competition from aggregators and roll-up firms is driving up valuations and making it harder for individual buyers to find undervalued opportunities.

Macroeconomic Factors: Fluctuating interest rates and inflation are impacting financing options and buyer confidence

Actionable Advice for Buyers & Sellers

For Sellers:

Optimize Operations: Streamline processes and document standard operating procedures to enhance business attractiveness.

Focus on Recurring Revenue: Businesses with subscription models or repeat customers are more appealing to buyers.

Prepare for Due Diligence: Maintain accurate financial records and be ready to provide detailed information during the sale process.

For Buyers:

Conduct Thorough Due Diligence: Assess customer acquisition costs, retention rates, and operational scalability.

Seek Undervalued Opportunities: Look for businesses with growth potential that may be overlooked by larger aggregators.

Leverage Flippa's Tools: Utilize Flippa's integrated legal, finance, and payment services to facilitate smooth transactions.

Thinking Of Selling Your Online Business?

Find out what it’s worth with our free and independent business valuation tool:

Get started with Flippa today - Sell your business.