Understand How Much To Sell A Business For

In the world of small business ownership, your company's profit is everything. It's not just a number your accountant shares with you or how much extra you can personally spend. Your business profit is a significant part of how much your business is worth. Understanding a business’s profit is understanding how much to sell a business for.

Profit not only makes you love your business; it also makes people who could buy it fall in love with it.

TL;DR: The Step-By-Step Process of Selling A Small Business

Know how much to sell a business for (that’s what THIS article is all about)

Increase the value of your business, before selling (READ THE BLOG →)

Build your exit deal team, list the business for sale, meet with buyers and negotiate the deal

Before we dive in…

What Exited Owners Would Do Differently

When I talk with business owners who have sold their businesses, many openly share with me what they would have done differently in the years before their exit. They tell me they wish they had focused less on growing their sales and more on profit margins.

Reasons Why You Need to Know Your Business’s Value

There are several situations where having a business valuation is necessary:

Selling or Merging. Knowing your business’s value helps you set a fair expectation around your selling price. This allows you to negotiate effectively with potential buyers or investors.

Investment Opportunities. If you are considering buying (a stake in) another business, it is crucial to accurately assess the value of that business to make sure you don’t overpay.

Performance Measurement. An increase or decrease in the value of your business over time is an indication of how the business is performing. This supports better decision-making.

Exit Strategy. Business valuations are a crucial step in exiting or planning the exit of your business. Just because your business has value, doesn’t mean it’s sellable. So a business valuation combined with an exit-readiness assessment can help you put your plan in place.

TL;DR: How Much To Sell A Business For

Knowing how much to sell a business for is not easy. Business value depends on your financials, potential for growth, customer relations, and how solid your operations are.

The most common way to calculate the value of a smaller business (defined as < $2M in annual revenue) is to multiply your EBITDA (Earnings Before Interest, Taxes, Depreciation and Amortization, a measure of profitability) by a factor (called ‘a multiple’) that's based on industry standards and the unique aspects of your business. This factor is called an ‘ebitda multiple’ and can vary anywhere between less than 1 to more than 10.

More on multiples and the current ones for your industry can be found further down this article.

The Valuation Method Depends On Your Business’s Size

There are several methods for determining how much to sell a business for. The best method for your business is decided based upon the size of your business.

Here’s an overview:

1. Small Businesses or ‘Main Street Deals’ (< $2M in Annual Revenue)

90% of businesses globally generate less than $2M in annual revenue, so we’ll start there.

Companies with under $2M in sales will typically be valued on a Multiple-Based Approach, an Asset-Based Approach or an Income-Based Approach.

Here at the Big Exit, we exclusively work with ‘small’ or ‘Main Street’ businesses generating < $2M in annual sales. When valuing your business, we will use a combination of these 3 methods to get the most accurate and reliable valuation.

2. Lower Middle-Market Companies ($2M – $100M in Annual Revenue)

The rule of thumb for these businesses is that there is no rule of thumb. Valuations could be anywhere between 4 to 15x adjusted EBITDA, depending on a whole list of factors.

3. Publicly Traded Companies (Typically $100M+ in Annual Revenue)

Publicly traded companies trade at a significant premium to that of private market companies. Again, there is no rule of thumb on what the arbitrage is in jumping from being a large, privately held company to a small, publicly traded company.

The One Metric That Affects Small Business Value

Your current business value is all about EBITDA. So you know now that building a business isn't just about making money. It's about making sure that money is turned into profit efficiently.

The higher the profit,

the more your small business is worth.

It’s as simple as that.

Related Content

Want to know the multiplier for business valuation?

Top 6 Online Businesses With The Highest Value In 2024

3 Business Valuation Methods for A Small Business

As mentioned earlier in this article, we make use of three common methods for small business valuations. With small, we mean businesses making less < $2M in annual sales, sometimes also referred to as ‘Main Street Businesses’.

1. Multiples-Based Approach

The market Multiples Based Approach is a common method to determine a business’s current value through comparison. It evaluates a company by comparing it to similar businesses in the same industry, known as ‘comps’. To find a company’s market value, one looks at recently sold comps, compares the valuation to their earnings (of profits) and then derives a multiple. For most industries, you can also find the most recent multiples online.

This multiple is then applied to your own profits to get to a valuation for your business.

The Multiples-Based Approach provides a relative value and, when combined with other methods like the 2 below, can offer an accurate picture of a company’s value. This method should be used as a sense check and in conjunction with other methods as no two companies are the same.

2. Income-Based Approach (Discounted Cash Flow)

The Income-Based Approach is commonly used to value operating (read: active) businesses. It calculates the current business value by projecting its future cash flows. This means estimating the expected net income over time and recalculating the present cash flow.

This method is a core component of how we value a small business, as it is a reflection if its growth potential.

3. Asset-Based Approach

The Asset-Based Approach, or Adjusted Net Asset Method (sorry about all this lingo) is the 3rd valuation method we apply. This method considers a company’s present value as the difference between the fair market value of its net assets and its liabilities.

It is particularly effective for valuing real estate, such as new construction or commercial properties, or asset-heavy businesses.

Are You Still With Me?

I Know, All This Lingo Is Hard.

The Good News… We’ll Sort It Out For You!

So…

What Information Do You Need To Calculate Your Business’s Value

Here’s what information you will need (or provide to us) in order to be able to calculate the value of your small business:

The date the business was created

The industry and sector you operate in (we give you options to choose from in our Business Valuation Tool)

Region of operations

Legal structure

Number of employees (we hope you know this by heart ;-))

Last 3 years financial statements (Income Statement and Balance Sheet - you might need to ask your accountant)

Details of working capital (Debtors, Creditors and your Bank balances)

Future financial forecasts and expectations (a rough estimate based on what you know about your market is sufficient)

Your current knowledge of how your business operated, your customers, growth, risks you are aware of and how much your business dependents on you.

For more complex businesses, like those lower middle-market or public traded businesses, lots more of additional specific information is required.

Calculate Your Business Value Now

We have a Business Valuation Report ready for you. It is FREE and you get your results IMMEDIATELY.

Here’s how you get the report:

Step 1: Gather the information listed above, to make the process smooth sailing.

Step 2: Click below on Calculate Now, put your info into our independent business valuation tool (we treat all your data confidentially).

Step 3: Instantly get your Business Valuation Report by email.

Why Should You Get An Independent Valuation

Getting an independent business valuation is essential for making informed decisions about your business's future.

Unlike M&A professionals, who may overinflate your business valuation to secure your listing or to push deals that don't align with your goals or the well-being of your team, an independent valuation offers an unbiased, accurate assessment of your business's worth.

By starting your exiting journey with an independent valuation, you gain a clear and objective understanding of your business's true value, setting the foundation for the best possible outcome.

Related Content

Understanding the true worth of your business is significant, and can be eye-opening.

Here’s how to come to terms with a low business valuation.

Is My Business Worth Selling?

Owners sell their businesses for many different reasons. Some want to start a new business venture and use the money from the sale. Others might be dealing with money problems or want to reduce those risks. It really depends on your personal situation and what you want for your future.

When to sell is a big decision. Some business owners prefer to sell now for a sure thing, rather than wait and face uncertain market conditions. Others wait until they're ready to retire or when they ‘have enough’ and want to get rid of the business. So knowing where you are on this journey helps you made the right decision about timing.

Just think carefully…

If your business is just going through a rough patch but could do better, it might be smart to improve things before selling.

If there’s a gap between what you want to sell for versus what your business is worth, it is smart to take your time to increase the value of your business.

So before you sell, take time to think things through.

Ask yourself what you want to achieve, both personally and financially. Think about how selling will affect you.

Once you decide to exit, your first step should be how much to sell a business for. This will help you get the best price possible whenever you sell.

Should I Use A Business Broker To Sell My Business?

The short answer is Yes, you should use a business broker when selling your business. We are not business brokers, so we have no benefit in saying you need one. But here’s the thing…

Business brokers will draw from their experience and expertise to offer you guidance and professional advice to ensure you make informed decisions.

1. What Does A Business Broker (Not) Do?

A business broker is an individual (or company) who helps you sell your company. They are knowledgeable about the market, have a network of potential buyers, and are skilled negotiators. They typically work small, main street businesses, worth less than $2M.

They handle a lot of the hard stuff like:

Finding buyers

Valuing the business

Marketing the sale

Handling negotiations

2. How Much Does A Business Broker Charge?

Business brokers usually charge a commission—around 5-15% of the sale price. It sounds steep, but after weighing this against doing all the hard stuff yourself, it’s probably money well spent.

Some brokers charge a monthly retainer. This will likely be on top off a (reduced) sales commission. From experience we can say that brokers who charge a retainer:

are not sure they can sell your business and want to reduce that risk by charging you a fixed fee

believe they will need to give you a lot of advice on how to increase the value of your business before they can sell it

3. How Do You Know If A Broker Is Good?

Finding the right broker for your business is key. Here are some tips to find the best one for you:

They need to have experience in your industry.

They need to have a good track record of selling.

They work on a sales commission only (which indicates they are confident they can sell your business).

They can answer simple questions like:

how many businesses just like mine have you sold in the last year

who’s been buying businesses like mine recently

of all the businesses like mine you couldn’t sell, what was the reason?

Certifications like Certified Business Intermediary (CBI) and memberships in groups like the International Business Brokers Association (IBBA) are indicator that someone is reputable.

Our clients get access to a vetted and curated list of business brokers which are perfect for them and their business.

4. What Can You (Not) Expect From A Business Broker?

Brokers can't guarantee a quick deal, even with their best efforts.

Brokers can’t sell an unsellable business.

Brokers work for a commission, so be mindful of conflicts of interest. They need to sell your business to make money. So even when the deal is not aligned with your, your business or your team’s best interests, they’ll push to close the deal.

Brokers will not spend much time on advising you on the changes you need to make to increase the value of your business.

Brokers might try to get your business listing by valuing your business (too) high. Don’t be tempted to work with a broker just because they gave you the highest valuation.

We recommend getting an independent valuation first.

5. When You Might Not Need A Broker

There are situations where you might not need a broker:

If you’re selling to a family member or employee: You probably already know the buyer well enough, and the price might already be set.

If you’ve sold businesses before: If you know what you’re doing and don’t mind the extra work, you can skip the broker and save on fees.

Even if you don’t use a broker, you’d still need to work with a lawyer and accountant when selling your business. They’ll help with the legal and financial details to make sure everything is airtight.

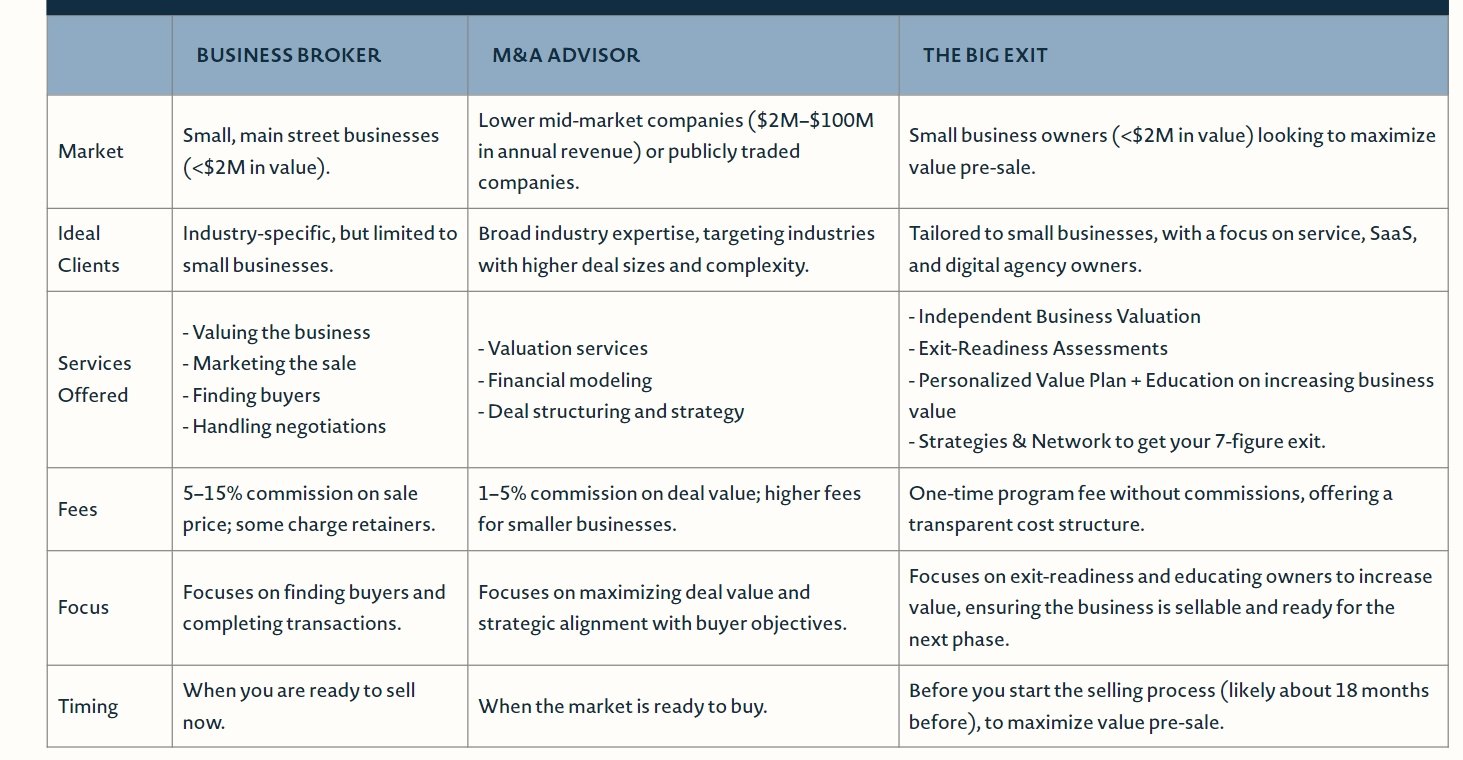

Difference Between Business Brokers and M&A Advisors

Business brokers tend to work on more straightforward transactions than M&A advisors. Brokers will cater primarily to regional markets or smaller sized businesses (< $2M in annual sales).

They focus on businesses that have fewer moving parts than the larger companies who are mostly handled by M&A advisors.

Should I Hire An M&A Advisor?

The short answer is No, you should not use an M& Advisor when selling your small business. But for completeness, here are the 3 most asked questions we get about M&A Advisors:

1. What Does An M&A Advisor (Not) Do?

M&A advisors or consultants provide valuation services for lower mid-market companies ($2M - $100M in annual revenue) or publicly traded companies. This involves analyzing financial statements, market conditions, and comparable transactions.

2. Do M&A Advisors Add Value?

A good M&A advisory firm can offer significant deal value for lower mid-market businesses, especially for owners with little or no prior experience in M&A, by building financial models that satisfy their financial objectives.

3. How Much Do M&A Advisors Charge?

As the deals and sales prices are higher than those of business brokers, the typical M&A fees are 1% to 5% of the deal's transaction value. Notably, the exact rate depends on many factors, including the deal's complexity and size. Generally, smaller deals result in higher percentage fees.

As M&A advisors normally work on selling businesses worth >$ 2M, they will charge higher fees for smaller businesses, and might not have the buyers for your business.

Comparing The Big Exit to Business Brokers and M&A Advisors

Who Would Buy My Small Business?

For small businesses (< $2M in annual sales) or so called ‘Main Street Businesses’ the unfortunate fact of the matter is that the market is somewhat illiquid. The most likely buyers of your business will be:

Another Company: This could be a strategic buyer, like a competitor, supplier or client of yours.

A Private Equity Firm: While there are more and more cases of private equity firms moving down market looking to buy smaller companies like those of our clients, we know they are very picky and are looking for niche, differentiated companies in the tech, SaaS, agency and more recently consulting and coaching space. These niche businesses are appealing as part of a roll-up strategy by these PE firms.

An employee

A family member

Let’s have a more detailed look at all of these…

1. Selling To Another Company, Including A Private Equity Firm

Advantages:

High potential profit. In a business acquisition, you negotiate the price. What is the company worth to a particular potential buyer? Does it offer strategic value to a buyer that would increase your price? In the right situation, the business’s value, and your profit from the sale, could rise.

Possible bidding war. One lucrative situation would involve a bidding war between two or more potential buyers. If your business appeals to several potential acquirers, you can let them compete to see who wants it most.

Potential synergies. Perhaps your company is a particularly good fit for another firm. You might have a strong position in a market segment that another company wants to expand into. Or you might own a proprietary technology, business process or a brand that is of particular value to a certain company. If the potential value of your firm and its assets is greater for a certain buyer, that should increase the sales price.

Disadvantages:

What if cultures clash? In some situations, your company might not fit well with another. If the two companies have different corporate cultures or ways of doing business, it could be harmful or counterproductive to merge the two. That might be difficult to know, but look for red flags when meeting with potential acquirers. Ask probing questions. Evaluate key personalities, business methods, and how open each organization is to change.

Possible loss of reputation. When you sell your company to another firm, you generally lose all control over your company’s brand. As a result, poor decisions by the new owners may be associated with you – and your personal reputation may be affected.

Loss of control. Without an ongoing connection to the business, you simply lose control over what used to be yours. Will you be able to accept that? Alternatively, you could structure the deal so that you’ll maintain some involvement through a transitional period. But again, that could lead to some stress or frustration, as you’ll no longer be fully in charge.

The Deciding Factor:

The main question to ask yourself is whether you’re really, truly ready to walk away. While selling to another company could be the most financially attractive decision, you’ll need to be comfortable that you’ll no longer have any say in how the business is run.

2. Selling To An Employee

Advantages:

Continuity. Selling to an employee could provide the most seamless and smooth transition. Your employees will continue to work with little change except they'll build on what they already know.

Simple and easy sale. If you sell to an employee, there’s little need for extensive financial due diligence. That also can ease stress over the transition to new owners and new management. The senior managers should already be familiar with the firm’s financial situation as well as its customers, products and competition.

Flexible terms. The terms of the transfer of the shares can be very flexible. You could sell your entire stake in the business now, do a partial sale, or gradually sell shares to an employee over multiple years.

Disadvantages:

It can be time-consuming. Selling to an employee can be time-consuming as an employee is not a professional buyer. They will likely be unfamiliar with how much to sell a business for and deal structures and they might not have the financial means to make a deal.

Can tie employee fortunes too closely to the company. While it can be positive to create a deeper bond between an employee and the business, from an asset allocation standpoint, it could be risky because of increased concentration. An employee already has a financial connection to the company through their job. Adding (partial) ownership to that adds to the risks if the company falters in some way.

Deciding Factor:

Do you believe your employee is capable of carrying on the business? Are they interested in doing so? This is an option that could work only if you have long-term employees who’ve helped you build your company, and want to continue it.

3. Selling To A Family Member

Advantages:

Familiarity and ease. You know, love and trust your family. Keeping it all in the family can give you a sense of comfort. Plus a healthy, thriving business could become a family legacy.

Continuity. If you have a strong bond with your children and they agree with your way of thinking and operating the business, this can provide the smoothest transition. You could plan for this years in advance.

Flexible terms possible. There are many ways to structure this type of sale. For example, you could receive a stream of income spread out over many years through an installment sale or a private annuity.

Disadvantages:

Family jealousies or rivalries. If your family members, particularly children, don’t get along or can’t see eye to eye, this could be a dangerous and risky situation. If you leave the business to children who don’t get along well, it could be a recipe for frustration, resentment and possible business failure.

What if your children aren’t interested or qualified? Try to be objective. Are your children qualified enough and interested enough to take the business to the next level? Do they deserve this opportunity? What’s best for the business? Are your family member’s best qualified to take the reins or is an outright sale to another firm or a sale to the company’s employees the smarter move?

Deciding Factor:

Do you have family members who are capable of running the business, and have the knowledge and desire to do so? Also, consider how this business sale may change the dynamic among your loved ones.

5 Ways How to Increase Valuation of A Company

Know Your Numbers:

Understand your current profit margins fully.Reduce Costs Smartly:

Find where you can cut costs without hurting quality.Increase Your Pricing:

Come up with smart ways to increase profit.Make Operations Efficient:

Improve and automate processes to save time and money.Focus on High-Profit Services:

Prioritize selling those services or products that give higher profits.

Related Content

Passive earnings boost your profit and your business value, without requiring to work harder.

6 Passive Revenue Ideas For Small Business Owners

Examples of Adding Value to a Company

1. Spending Less

Cut costs cleverly to increase profit without reducing quality. Think about renegotiating contracts with suppliers you’ve worked with for years, where you’ve always paid on time or have increased the yearly volumes you’ve bought from them. These are all great reasons to renegotiate existing contracts. Bigger profit margins make your business worth more

2. Earning More

The prices you charge directly affect your profits. Have you regularly increased prices, to align with inflation? You would be surprised how few owners actually do this, and have a mechanism built into their sales contracts.

Know which products or services not only sell best, but which ones make you the most profit. Those are the ones you want to double down on.

3. Making Business Easier

Being efficient drives profitability. Make operations easier and efficient. This cuts costs, makes customers happier, and shows potential buyers your business model is strong.

The first step to take is to document how things are being done now and agree on the best way to do it. Once you’ve standardized everyone’s way of working and things are easier, automate as much as you can.

4. Make the Business Independent of You

If you're attracting most of the business, try to build up your company's brand and bring other faces of your team into the marketing and sales conversations.

If you're the only person making decisions, you're a risk to your business, and your business is unsellable (unless you want to work with the buyer for a long time).

“It is impossible to sell a business

that is completely dependent on you.”

Related Content

Let your business become independent of you and get your team in place.

Here’s how your team can triple your exit price and

how remote teams impact business valuations.

How Sarah Increased the Value of Her Business

Sarah, who owned a marketing consultancy, doubled her EBITDA in a year by focusing on those services that made more profit, rather than those that brought in the most revenue.

She also focused on standardizing how client work was done, so her small team started working efficiently. They also saw opportunities to work with a cheap software tool to support them in executing projects for clients.

These two changes led to a successful and profitable business sale.

A Report You Have To Know As A Female Founder: The Gender Gap in Business Exits [2024 Insights]